Benefits of having an offshore bank account

Confidentiality

Reputation

Cost efficiency

Interest incentives

Corporate clients

Companies opened

Customer satisaction

Have returned for a second service

Open a physical business bank account

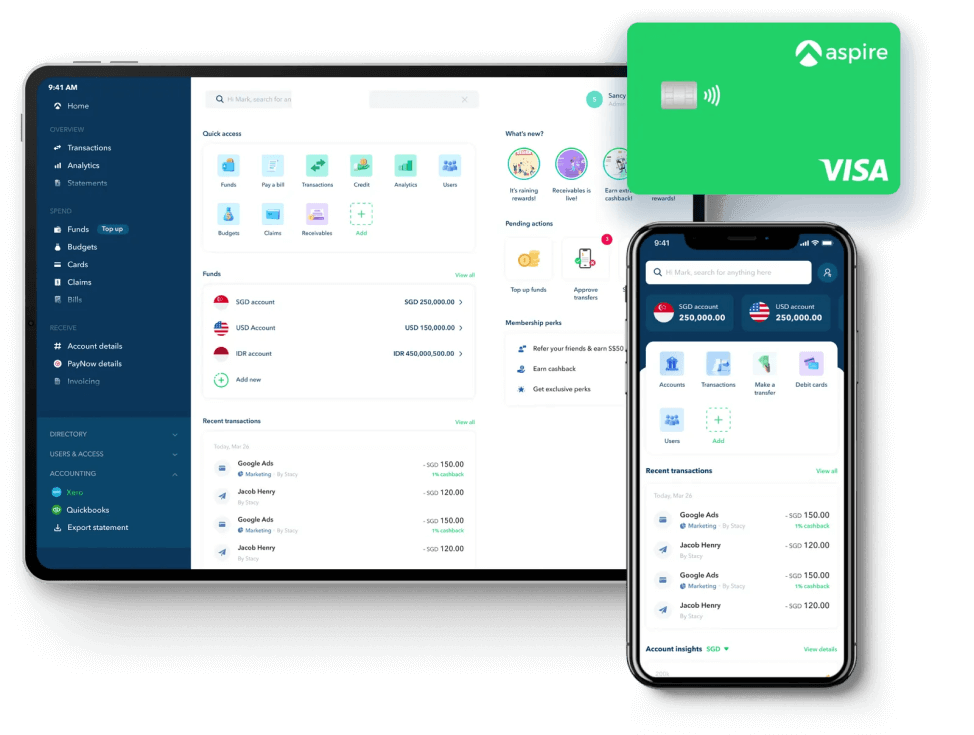

Opening a digital bank account

Whitelist Aspire accounts

The benefits of opening an digital banking account with JNT:

- Online account opening, no physical visit

- Whitelisted and protected under the the name of JNT

- Fully online account management

- Streamlined international money transfers with competitive exchange rates

The process of bank account opening The process of bank account opening

Verify your business information (KYB)

Throughout this phase, our team will address several key questions to provide tailored advice:

- Are you seeking legal measures to minimize taxes through a foreign bank?

- What is the nature of your intended business?

- How is your company structured?

- What are the anticipated patterns of incoming and outgoing transactions?

- What is the nationality of your directors and shareholders?

Prepare your business plan

At JNT Consultancy & Services, we aspire to see this business plan through to completion. Subsequently, we will adeptly present the necessary documents to our preferred banking partners on your behalf.

Network screening

You will receive pre-filled account opening forms for your chosen banks. Once you’ve completed these forms, our team will conduct a meticulous review of the documents before submitting them to the respective bankers. We will also continue to engage in negotiations to ensure the successful opening of your account.

Throughout this process, JNT will act as a dedicated intermediary between our clients and the banks. Our clients’ primary responsibility will be to review and sign the company’s bank account opening forms.

Prepare for the interview

Finalize the process

Typically, our business bank account opening service is completed in an average of 5 weeks. Clients can expect to gain access to online banking functionalities within just 2 weeks following the official account establishment.

Our partners

Contact us